Financial targets

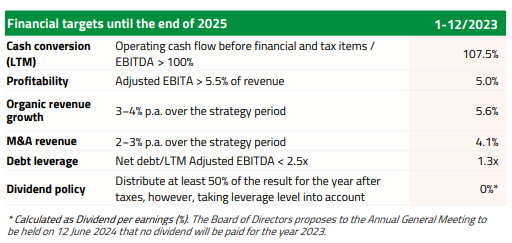

Caverion updated its financial targets on 9 May 2022. Caverion’s mid-term financial targets until the end of 2025 are:

Financial targets

| Cash conversion (LTM) | Operating cash flow before financial and tax items / EBITDA > 100% |

| Profitability | Adjusted EBITA > 5.5% of revenue |

| Organic revenue growth | 3−4% p.a. over the strategy period |

| M&A revenue growth | 2−3% p.a. over the strategy period |

| Debt leverage | Net debt/LTM Adjusted EBITDA < 2.5x |

| Dividend policy | Distribute at least 50% of the result for the year after taxes, however, taking leverage level into account |

Actions to reach the profitability target:

- Growth throughout businesses and divisions

- Focus on evolving business mix towards Solutions business at the higher end of the value chain, including Advisory, Engineering and Digital solutions, Managed Services as well as Smart solutions

- Operating and financial leverage as well as improving scalability and efficiency

- Productivity improvement by sharing common expertise across the company

- IT and digital transformation

- M&A activities

Previous financial targets and results 2023